Business

- 1

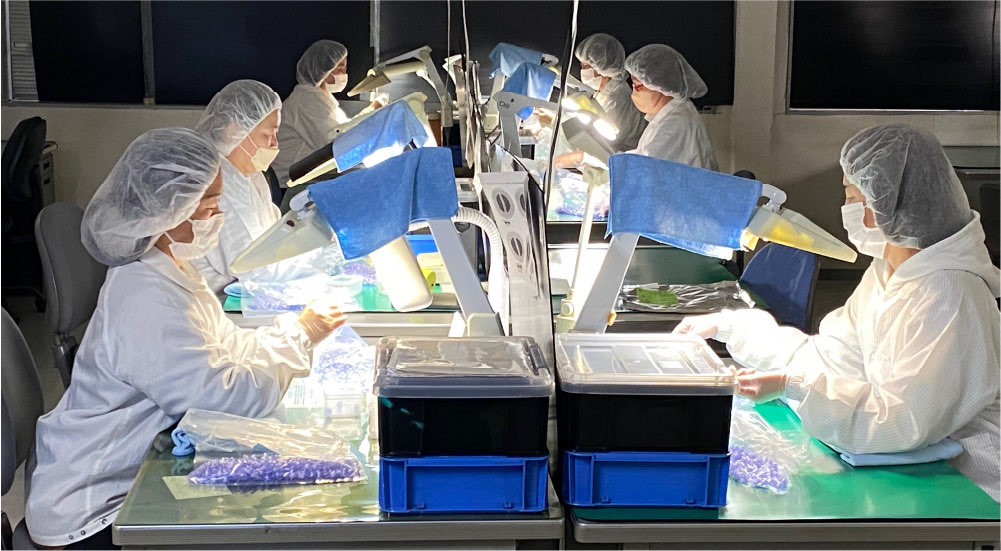

- Small parts visual inspection, sorting (By Partner company)

Storage, packing, labeling agency(By Partner company)

- 2

- Attorney for customs procedures(ACP), Consumption tax representative

(Support overseas customers who deal with DDP business or operate own EC site to sell in Japan)

- 3

- Overseas trading agency & consultant

Remarks: there may be cases we are unable to deal for below parts

✓In Principle we perform visual inspection with 3x magnifying glass by hand. It may be difficult

to inspect heavy parts

✓Parts which is NOT accompanied with legal required labels or legal approval if required

✓Parts which is not suitable for room temperature storage

✓In principle, foods, animals & plants, dangerous goods, uncured chemical products

1.Visual inspection, sorting, storage, packing, shipping

We have experience of visual inspection for automotive parts and medical small parts based on Japanese customer standard for 30 years.

We perform visual inspection with 3X magnifying glass based on client's standard & boundary samples, hence we support you by consignment of bothersome inspection to us.

It is ideal to already inspect within your country before exporting. Should you have demand due to various constraints,

We as an experienced company assume your task for inspection, weighing, packing, labeling and shipping on your behalf.

2.Attorney for customs procedures(ACP), Tax representative

Attorney for Customs Procedures(ACP) is legally required to nominate if foreign company itself import to Japan

for the purpose of appropriate import declaration & tax payment.

ACP undertakes import declaration to customs, handling customs inspection when foreign company itself import and

perform adequate coordination with forwarder, customs broker on your behalf.

Consumption tax representative is legally required to nominate when foreign company submits consumption tax report to tax office per each year.

Consumption tax representative perform consumption tax report on your behalf.

In this case, consumption tax paid to customs upfront at import can be counted as advanced tax payment,

thus nominating ACP and tax representative to the same company will reduce a lot of your work load of tax treatment.

In addition, you may assign storage, inspection, customer return to us as one stop entrustment, contributing to reduction of your administrative procedures.

Views of Inspection, shipping area

1F office

1F weighing work

2F inspection

Views are for inspection for industrial valves